What to do if you can’t pay your tax bill is a challenge many face, but there are solutions. Firstly, it’s important to stay calm and take action immediately. Ignoring the issue will only make matters worse. Additionally, remember that tax authorities are usually willing to help when approached. Communication is key.

Options to Manage Your Tax Bill

When you find yourself unable to pay, there are several options to consider. For instance, you could arrange a payment plan with the tax authorities. This method, known as a Time to Pay Agreement, allows you to spread payments over time. Moreover, it’s crucial to have an open dialogue with the tax office to explain your situation.

Alternatively, you could explore ways to reduce your tax liabilities. For example, checking if you qualify for reliefs, deductions, or allowances could lower the amount owed. Equally, reviewing your financial situation may help identify areas where you can free up cash to meet your obligations.

Steps to Take Immediately

Before taking any action, calculate the total amount owed to avoid confusion. Then, prioritise reaching out to your tax office, as they can offer guidance tailored to your circumstances. Furthermore, if you cannot resolve the issue directly, consulting a financial advisor can provide clarity and direction.

Another important step is to avoid late filing or non-payment penalties. Consequently, even if you can’t pay the full amount, submitting your tax return on time is vital.

The Bigger Picture

What to do if you can’t pay your tax bill involves more than immediate solutions. Planning ahead ensures you avoid such situations in the future. Setting aside funds regularly or seeking professional advice can help you better manage tax obligations.

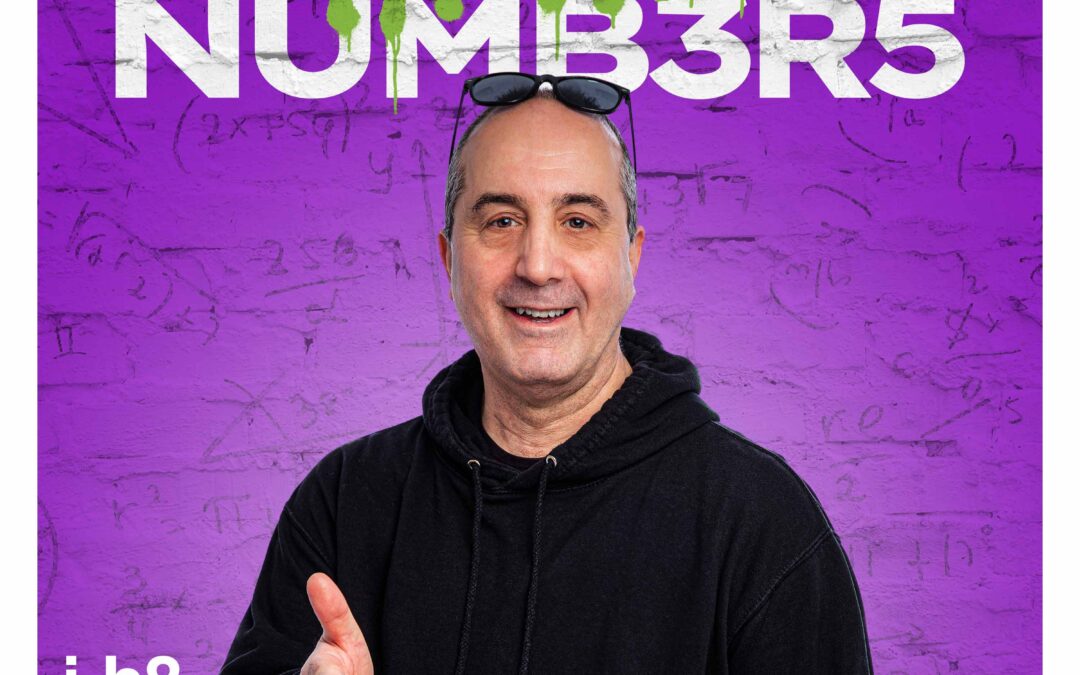

Finally, understanding your options is the first step towards resolving financial difficulties. Listen to the I Hate Numbers podcast for practical tips and expert advice to help you tackle tax challenges with confidence.