UK business taxes impact every company, regardless of size or industry. Accordingly, understanding tax obligations helps businesses plan effectively. Additionally, knowing the different taxes applicable ensures compliance while avoiding penalties.

Types of UK Business Taxes

Corporation Tax

Corporation tax applies to limited companies on their profits. Currently, businesses must calculate their taxable income and file returns with HMRC. Moreover, proper record-keeping ensures accurate reporting and reduces tax liabilities.

Value Added Tax (VAT)

VAT applies when businesses exceed the registration threshold. Furthermore, companies must charge VAT on taxable sales and submit returns regularly. However, certain businesses qualify for VAT exemptions or special schemes, which simplify compliance.

Income Tax and National Insurance

Self-employed individuals pay income tax on profits instead of corporation tax. Moreover, National Insurance contributions (NICs) apply based on earnings. Consequently, proper tax planning helps manage cash flow and prevents unexpected liabilities.

Business Rates

Companies operating from commercial premises pay business rates. Although local authorities handle business rates, reliefs exist for small businesses. Additionally, reviewing rateable values ensures businesses do not overpay.

Tax Planning for Efficiency

Strategic tax planning reduces liabilities while maintaining compliance. Moreover, claiming allowable expenses, utilising tax reliefs, and choosing the right VAT scheme significantly impact finances. Furthermore, seeking professional advice ensures businesses make informed decisions.

Staying Compliant with UK Business Taxes

Businesses must file returns accurately and meet deadlines. Otherwise, penalties and interest charges apply. Similarly, using digital accounting software simplifies tax management and ensures timely submissions. Significantly, keeping updated with tax law changes prevents compliance issues.

Final Thoughts

UK business taxes shape financial decisions and impact profitability. Therefore, proactive tax management helps businesses operate efficiently. Moreover, staying informed and seeking expert advice leads to better financial outcomes.

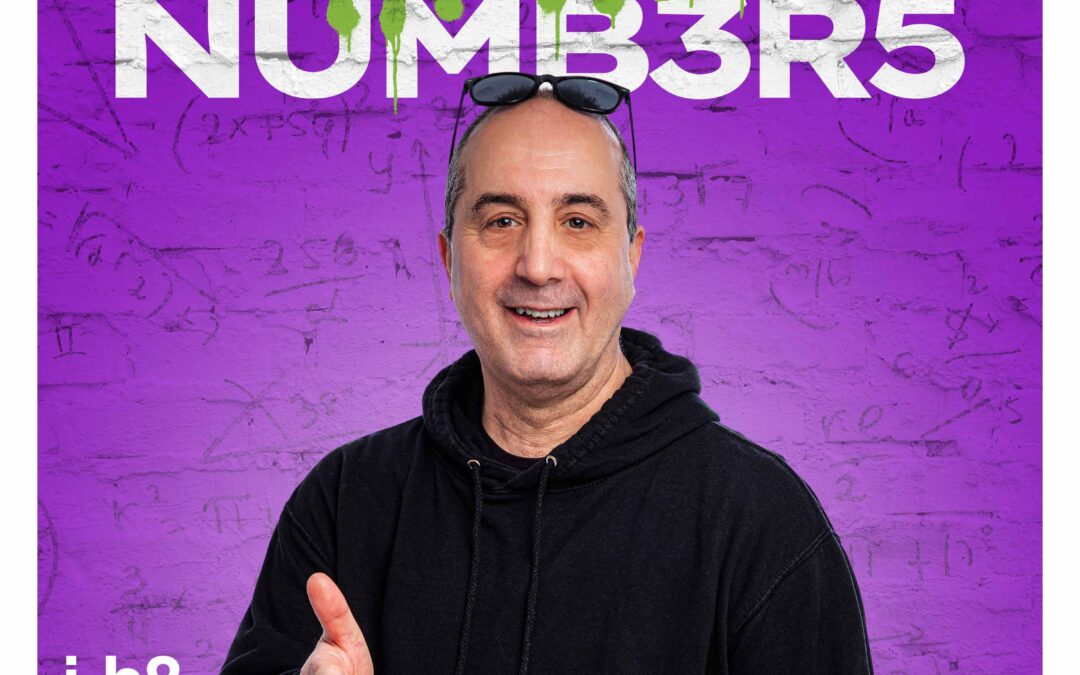

Listen to the I Hate Numbers podcast for more insights on managing business taxes effectively. Additionally, explore our resources to enhance your financial knowledge and strengthen your business.