Why Financial Jargon Feels Like a Foreign Language

Jargon can make financial discussions feel like navigating an unfamiliar country without knowing the language. Additionally, many business owners struggle with terms like equity, liquidity, and ROI, which can lead to confusion and uncertainty. However, understanding the basics helps us take control of our business finances. Likewise, learning key financial phrases makes decision-making easier and reduces frustration.

The Risks of Not Understanding Jargon

Without a basic grasp of financial jargon, we risk making uninformed choices. For instance, imagine trying to negotiate with lenders or investors without fully understanding the terms they use. Consequently, misinterpretation could result in costly mistakes or lost opportunities. Nevertheless, not knowing the language sometimes leads to unexpected advantages, because creative problem-solving emerges when we think outside conventional financial frameworks.

Essential Financial Terms Every Business Needs to Know

Understanding key financial terms allows us to manage our businesses effectively. Furthermore, these terms provide clarity when making financial decisions. Some essential ones include:

-

Revenue – The total income a business generates before expenses. Therefore, this figure represents the starting point for financial analysis.

-

Profit – What remains after deducting costs from revenue, showing actual earnings. Accordingly, higher profits indicate better financial health.

-

Liquidity – How quickly assets convert to cash, affecting financial flexibility. Likewise, strong liquidity ensures that unexpected expenses can be managed easily.

-

Assets – Valuable business items like equipment, inventory, and cash reserves. Moreover, assets contribute to a company’s overall value.

-

Liabilities – Debts and financial obligations that require careful management. Consequently, businesses must ensure they do not accumulate excessive liabilities.

-

ROI (Return on Investment) – A measure of profitability from investments made. Evidently, a higher ROI signifies more effective resource utilisation.

Grasping these terms is like learning survival phrases in a new language. Similarly, we do not need complete fluency, but knowing the essentials helps us make smarter business decisions.

How Jargon Fluency Strengthens Our Business

When we understand financial jargon, we gain confidence, negotiate better, and avoid costly missteps. Additionally, we recognise financial patterns, improve forecasting, and make strategic decisions with greater clarity. Eventually, this knowledge leads to more stability and growth. Furthermore, learning the right financial terms allows us to engage in meaningful discussions with investors and lenders.

Final Thoughts

Jargon should not be a barrier to business success. Moreover, learning essential financial terms makes decision-making easier, reduces uncertainty, and improves financial management. Instead of feeling lost in translation, we can confidently steer our businesses forward.

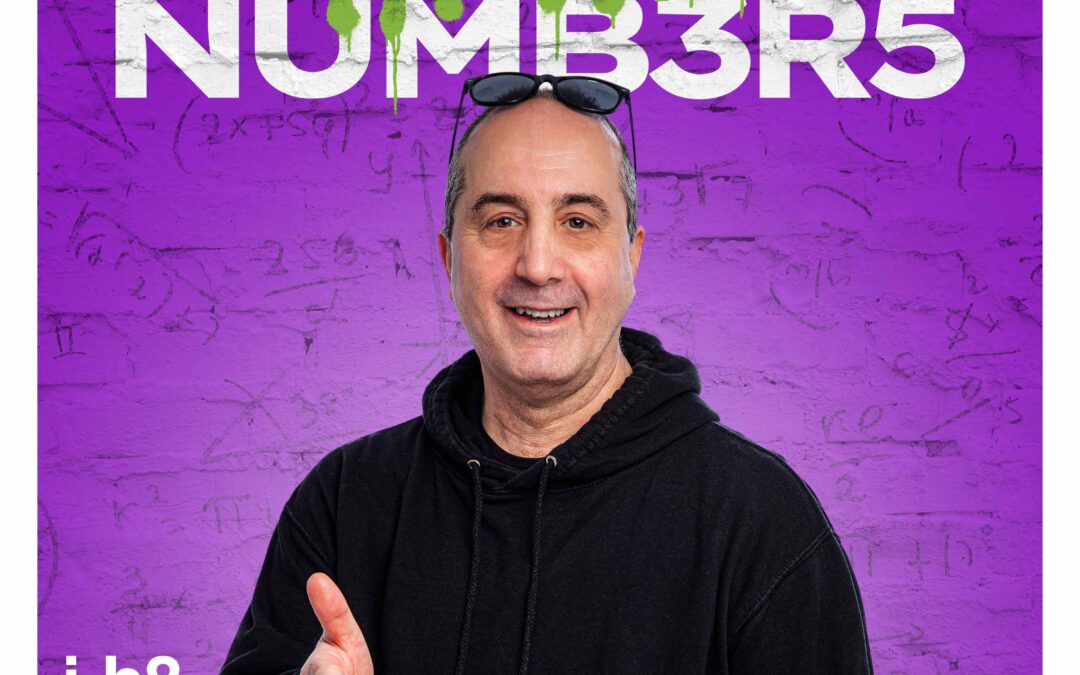

Listen to the I Hate Numbers podcast for more insights on financial success. Furthermore, stay informed, stay empowered, and keep your business on the right