Financial accountability is more than tracking money—it is the compass that keeps our business heading toward the right destination. Evidently, without clear direction, we risk getting lost in daily chaos. However, when we embrace responsibility for our numbers, we take control of our journey.

Planning With Purpose

Firstly, running a business without financial accountability is like setting off on a road trip without a map. Secondly, although we may eventually arrive somewhere, it likely won’t be where we intended to go. Consequently, we must define our goals, plan our route, and prepare for the unexpected.

Moreover, our financial story plan becomes our guide. Besides being our route map, it keeps us honest and focused. Furthermore, just like a personal trainer tracks our fitness, our plan helps track profit targets, expenses, and resources. Hence, it must stay visible, current, and part of our weekly and monthly routines.

Reviewing and Reflecting Regularly

Undoubtedly, we must check our dashboard—our digital accounting system—frequently. Accordingly, we can monitor whether sales match forecasts, expenses stay within limits, and profits align with projections. Additionally, when things go off course, we do not panic. Instead, we reroute, reflect, and readjust.

Certainly, unexpected events will happen. Nevertheless, strong financial accountability helps us respond with clarity. Specifically, reviewing metrics like cashflow weekly, or even daily, gives us real-time control.

Building Habits for Long-Term Success

Emphatically, our financial plan is not a one-off task. Instead, it lives and breathes with our business. Previously missed goals become future milestones. Additionally, celebrating small wins keeps motivation high. Lastly, asking reflective questions helps identify blind spots and improve decisions.

Keep Moving Forward

Altogether, financial accountability gives us power, direction, and peace of mind. It may not guarantee a smooth ride, but it ensures we keep moving toward our goals. Therefore, let’s stop guessing and start owning our path.

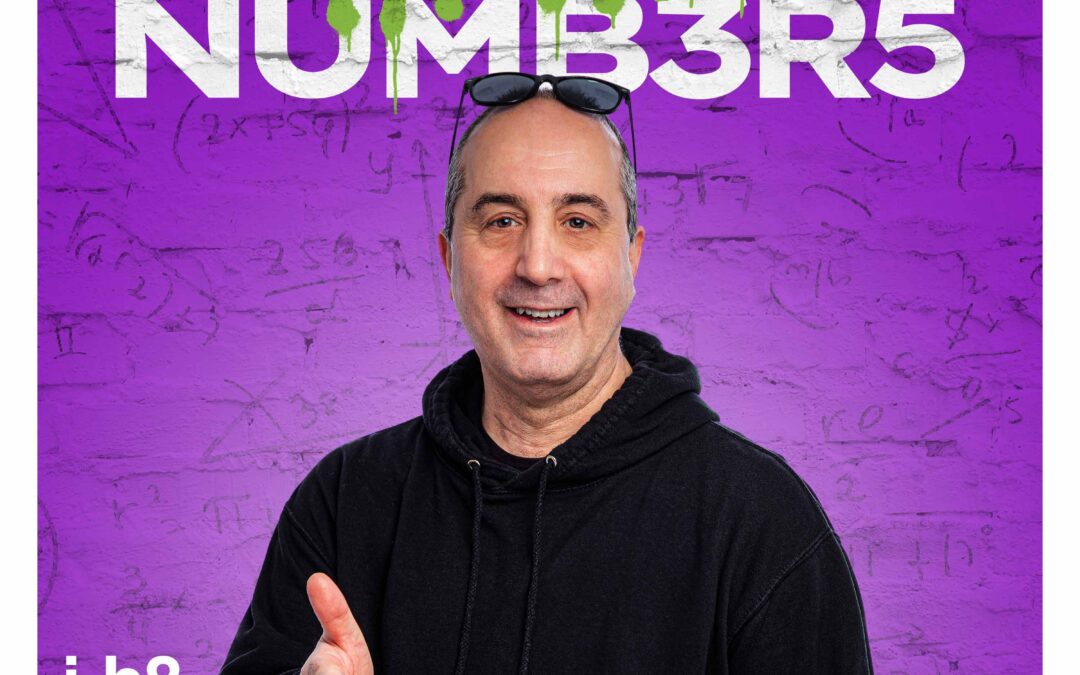

If this episode sparked new thoughts or gave you something to act on, then keep the momentum going. Listen to the I Hate Numbers podcast for more practical insights, guidance, and tools to help you take charge of your finances. Let’s keep building smarter, stronger businesses—together.