Understanding the tax treatment for sole traders in the United Kingdom is crucial for managing your business finances effectively. Sole traders, unlike limited companies, operate without legal separation between personal and business finances. This structure may be simpler, but it comes with unique tax obligations.

What It Means to Be a Sole Trader

As a sole trader, you take home all the profits after taxes, but you are also personally responsible for any business debts. For instance, Alex, a freelance photographer, must manage his income and expenses carefully to ensure proper tax reporting. Similarly, registering with HMRC is a vital first step. Sole traders need a Unique Taxpayer Reference (UTR) to file annual self-assessment tax returns.

How Taxation Works for Sole Traders

Sole traders are taxed on their business profits, not their total income. For example, Sarah, a baker, earns £40,000 from her sales but spends £10,000 on business expenses. Her taxable profit is £30,000. In the UK, income tax thresholds vary, with a personal allowance of £12,570. Any profits exceeding this amount are taxed at rates between 20% and 45%, depending on the income bracket.

National Insurance Contributions

Additionally, National Insurance Contributions (NICs) apply to sole traders. Class 2 NICs are a flat rate, while Class 4 NICs depend on profits, with rates starting at 9% for profits over £12,570. For Sarah, this would mean an NIC bill of £1,748 in addition to her income tax.

Key Deadlines and Record-Keeping

It is important to file your tax return by 31 January following the tax year. Keeping detailed financial records simplifies the process and ensures compliance with HMRC requirements. Tools like BudgetWiz can help with tracking income and expenses efficiently.

Final Thoughts

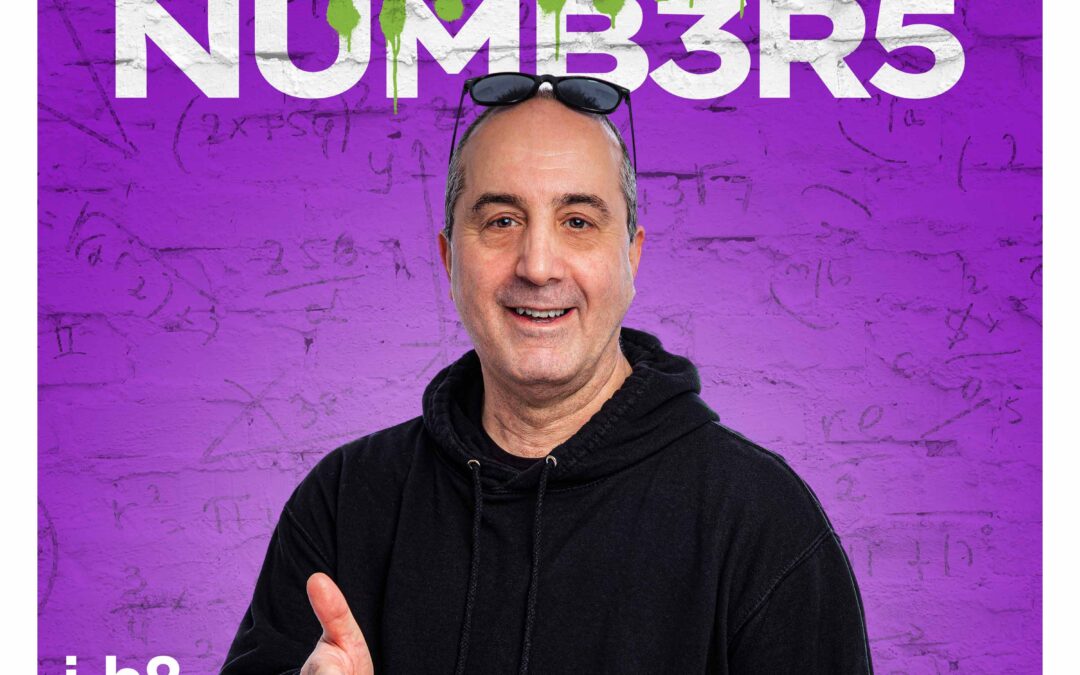

Managing the tax treatment for sole traders may seem daunting, but it becomes manageable with proper guidance. For more tips and insights, listen to the I Hate Numbers podcast, where we simplify finance for business success.