Small businesses can often struggle to make ends meet if they don’t have a good billing process in place. That’s why, in this blog, we’ll focus on the 5 common billing mistakes that can hurt your financial health and how to avoid them.

The general topic of this blog is actually one that you may have heard before: cash flow management. But, we’ll be looking at it from the aspect of common billing mistakes.

Cash flow management and billing mistakes

How is this connected you may ask. Well, if you’ve got a bad billing process as a small business owner, you’re definitely going to feel that in your cash flow metrics. You’ll be running out of cash sooner rather than later, and you’ll be having difficulties surviving as a business. And it’s all because of these common billing mistakes that you may or may not know you’re doing.

So, if you’re ready to alleviate cash flow pressure and improve your billing processes (farewell common billing mistakes!), click the video thumbnail below and watch this short and informative video.

Master your billing process

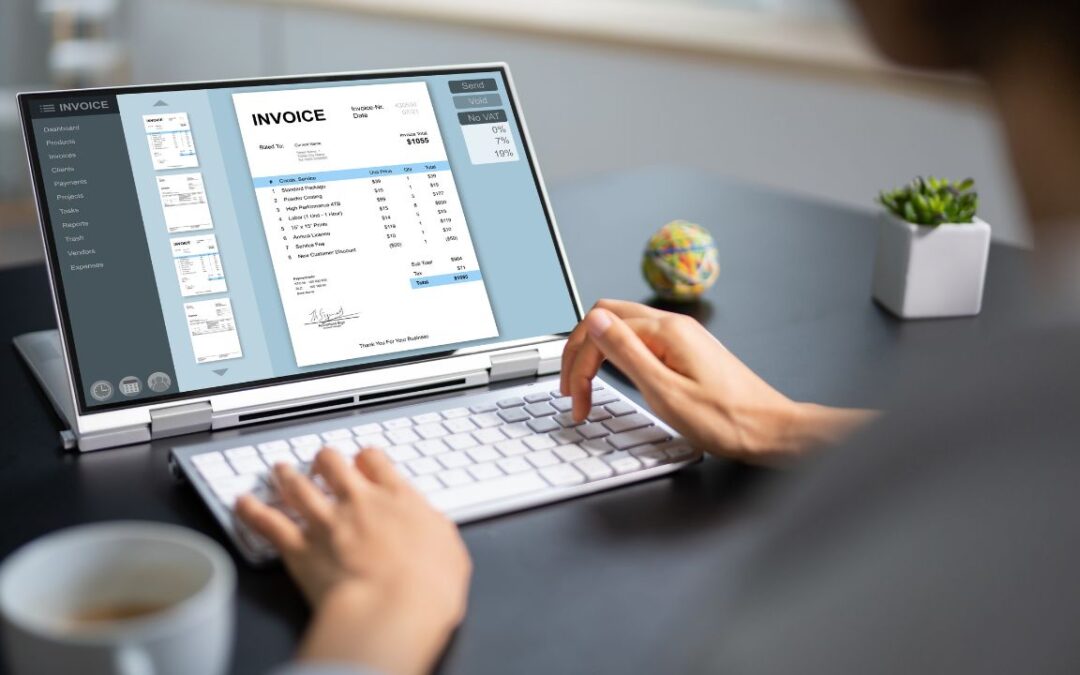

When you avoid these 5 common billing mistakes, you will establish a regular invoicing routine. This will allow you to improve your cash flow and ensure timely payments from clients. By being consistent, clear, and organised in your invoicing practices, you can ease cash flow pressure and create a more efficient billing process. If you don’t already have a digital invoicing system in place, consider setting one up to automate tasks and enhance your overall financial management.

Fix these 5 common billing mistakes. And when you know that your finances are in check, it is easier to navigate business waters. Online apps like Budgetwhizz® make keeping track of your cash flow and financial planning easier. Stay organised so you can focus on what matters to you; the creative work and the impactful change. Take a step away from the chaos with fast setup & easy navigation – numbers just got real…for the better! Get organised & make sense of it all with Numbers Knowhow® today.

Plan it, Do it & PROFIT!